- Bitcoin Hits $85,000 as Institutions Buy

- Doodles NFTs Record $16 Million in Trading Volume Following $DOODS Memecoin Announcement

- Strategic Push - MAP Coin Prepares to List on BitMart

- Japan's Metaplanet Expands Bitcoin Reserves to 4,046 BTC, Optimizes Buying Strategy

- Digital Asset Outlook 2025: A Comprehensive Analysis by The Block

- Web3’s Lighthouse Amidst the Global Economic and Geopolitical Storm

Bitcoin Hits $85,000 as Institutions Buy

Bitcoin continues to rally as major institutions step up their buying, reinforcing market confidence in the leading digital asset. Stablecoin giant Tether and Japanese Bitcoin fund manager Metaplanet are the latest to join the accumulation wave, sending Bitcoin prices to $85,000.

Tether and Metaplanet Expand Bitcoin Reserves

On April 1, Tether – the world’s largest stablecoin issuer – revealed that it had purchased an additional 8,888 BTC in the first quarter of 2025, bringing its total Bitcoin holdings to nearly $7.8 billion. On the same day, Metaplanet announced that it had added 696 BTC, bringing its total Bitcoin holdings to 4,046 BTC.

These moves are a clear sign of growing interest from financial institutions in Bitcoin, especially when they use financial strategies to optimize accumulation. Metaplanet recently issued a $13.3 million (2 billion yen) bond to raise funds for Bitcoin purchases, further expanding its digital portfolio.

Bitcoin Price Movements and Trading Activity

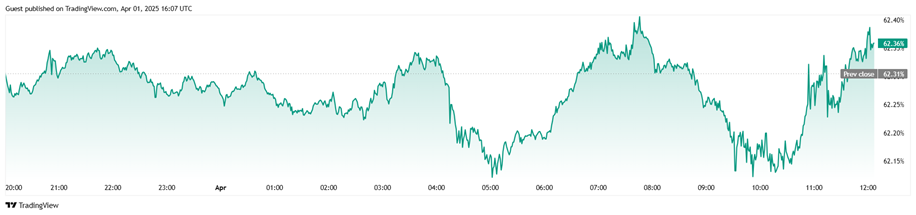

At press time, Bitcoin is trading at $85,240, up 2.01% from the previous day, but still down 2.86% over the past week. Over the past 24 hours, BTC has fluctuated between $82,263 and $85,487, with a trading volume of $27.45 billion, up 0.37%.

Bitcoin’s market capitalization is now $1.69 trillion, up 2.22% from the previous day. However, Bitcoin’s dominance in the cryptocurrency market has slightly decreased by 0.09% to 62.37%. Meanwhile, the total number of BTC futures contracts open increased to $55.38 billion, reflecting a 3.03% increase as traders held on to their leveraged positions.

According to data from Coinglass, the total value of liquidations in the past 24 hours reached $25.64 million, of which buy orders liquidated only $443,490, while sell orders liquidated up to $25.19 million. This shows that the bears have bet on the wrong direction as Bitcoin prices continue to rise.

Bitcoin Trend Forecast

With the active participation of major financial institutions such as Tether and Metaplanet, Bitcoin is receiving solid support from fundamental factors. Analysts believe that BTC could continue to test the mid-$80,000 level, but strong institutional accumulation could push the price to $90,000 in the coming weeks.

However, the market is still subject to volatility due to liquidation pressure from short positions. Investors should closely monitor the movements of large institutions, as the buying trend from funds and businesses could be a major driver of Bitcoin's future price momentum.