- Coinbase CEO Calls for Stablecoin Interest Rate Legislation to Create Financial Equity

- MAPSWAP: REVOLUTIONIZING DEFI TRADING WHERE TRUST MEETS INNOVATION!

- Byzantine Finance Raises $3 Million in Pre-Seed Funding

- PancakeSwap surges 40% as weekly turnover hits $19 million

- TRON'S BIGGEST SPONSOR BUYS TRX FOR $110 MILLION, DOUBLING COMPANY'S EQUITY TO $220 MILLION

- Bitwise Raises $70 Million, Backed by Electric Capital, MassMutual, and Haun Ventures

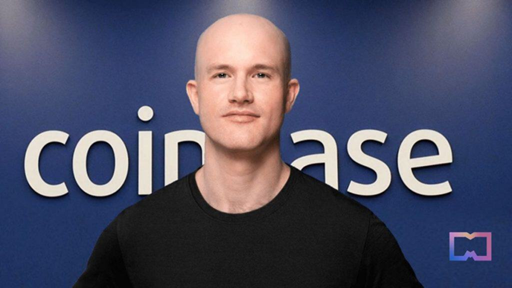

Coinbase CEO Calls for Stablecoin Interest Rate Legislation to Create Financial Equity

Coinbase CEO Brian Armstrong has called on US lawmakers to support stablecoin legislation that would allow consumers to earn interest directly on their digital holdings. He called it a “win-win” solution that would improve financial access, boost the global economy, and strengthen the financial health of the United States.

Stablecoin Interest Rates: A Solution to Create Financial Equity

In a detailed post on March 31, Armstrong emphasized that stablecoins are increasingly popular as a digital representation of fiat currencies. However, they have yet to reach their full potential because users do not benefit from the yields on reserve assets that back stablecoins, such as short-term US Treasury bonds.

While banks can offer interest-bearing accounts under regulatory exemptions, stablecoin issuers face regulatory hurdles that prevent them from sharing interest with users without violating securities laws, Armstrong said. This deprives consumers of a legitimate and significant source of income.

“Consumers deserve a bigger slice,” Armstrong asserted. “Legalizing stablecoin interest would level the playing field, forcing the entire financial system to improve for consumers.”

Fighting Inflation, Protecting Purchasing Power

Armstrong emphasized that stablecoin interest could help protect people’s purchasing power, especially in a context where inflation remains high. Currently, the average Federal Funds rate in 2024 is around 4.75%, but most consumers earn less than 0.5% – or even as little as 0.01% – on their savings accounts. Meanwhile, inflation nearing 3% is eroding the real value of cash.

“On-chain interest democratizes access to market-based yield, giving people a fair chance to maintain and grow their wealth,” Armstrong explained.

In addition, stablecoins could become a key solution to making financial access easier for billions of people in underdeveloped regions. Integrating interest into stablecoins would allow people in countries without a stable banking system to store and grow their wealth with just an internet connection.

“No need for bank branches, no need for high transfer fees – this is equal financial access for everyone, powered by blockchain technology,” he emphasized.

Strengthening the US Economy

Armstrong also believes that legalizing stablecoin interest would bring strategic benefits to the US economy. Stablecoin issuers are now among the largest investors in U.S. Treasury bonds, surpassing many foreign governments. If global consumers could earn interest on U.S. stablecoins, demand for the U.S. dollar would surge, cementing its position in international markets.

“Higher yields for consumers would spur spending, saving, and investment—creating economic growth for all economies that use stablecoins,” Armstrong said.

However, he also warned that if the United States fails to act quickly, it could lose trillions of dollars in financial capital to other jurisdictions with more flexible policies.

A Call to Action

Armstrong urged Congress to quickly establish clear regulations for stablecoins, allowing stablecoin issuers to offer on-chain interest without being bound by complex disclosure requirements or being classified as securities.

“We have a unique opportunity to modernize our financial system for the benefit of consumers. Failure to act will only preserve an outdated system that only benefits financial intermediaries,” Armstrong warned.

Legalizing stablecoin interest rates would not only help individuals protect their wealth against inflation, but would also help the United States maintain its position as a global financial center. This requires swift action by lawmakers to promote a more transparent, fair, and efficient financial system in the blockchain era.

-238x178.jpeg)