- Crypto Fear and Greed Index Drops to 25, Enters “Extreme Fear” Zone After Trump’s Tariff Announcement

- Grayscale Files Spot ETF for Polkadot Amid Altcoin ETF Race

- Doodles NFTs Record $16 Million in Trading Volume Following $DOODS Memecoin Announcement

- The Impact of Fed's Interest Rate Decision on Crypto Markets This Week

- Record $1 Billion Outflows From US Spot Bitcoin ETFs

- Bitcoin Miner Revenues at Risk as Transactions Decline

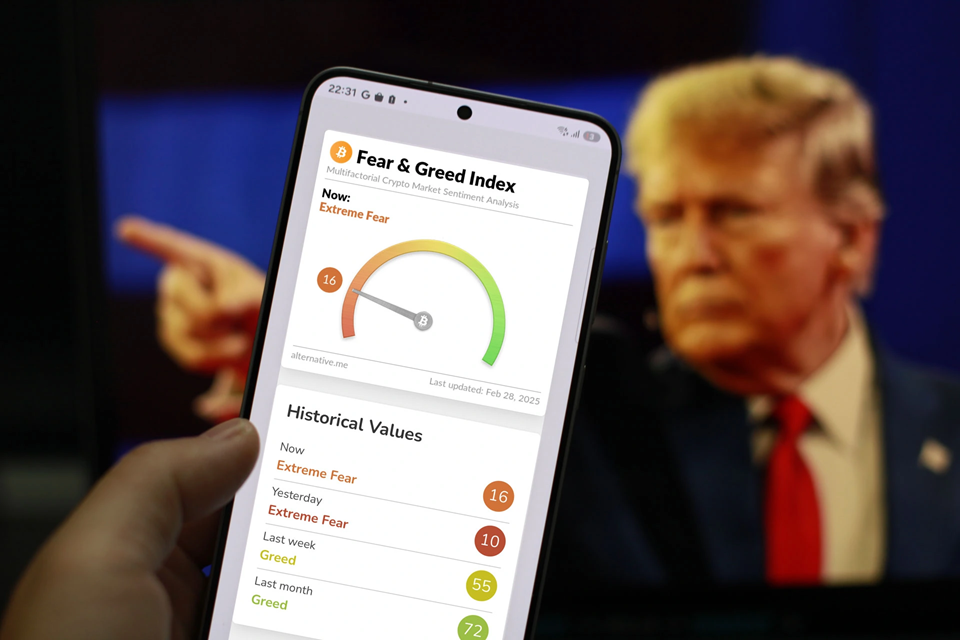

Crypto Fear and Greed Index Drops to 25, Enters “Extreme Fear” Zone After Trump’s Tariff Announcement

The cryptocurrency market is experiencing a volatile period after US President Donald Trump announced new tariffs, which have had a major impact on both traditional and digital asset markets.

Fear and Greed Index Plunges

On April 2, the Crypto Fear and Greed Index dropped to 25, down 19 points in just one day, officially pushing the market into the “Extreme Fear” zone. This reflects investors’ concerns about the sharp fluctuations in the financial markets.

The main cause of the decline was Trump’s announcement of new tariffs, dubbed “Liberation Day,” which imposes a 10% tax on imports and higher tariffs on specific countries.

New tax policy and impact on the economy

According to the announcement, China is the country most affected with a 54% tax rate, which includes a new 34% tax rate plus the current 20% tax rate. The European Union is subject to a 20% tax rate, while countries such as Vietnam (46%), Taiwan (32%), India (26%) and Japan (24%) also face higher tariffs.

Canada and Mexico are temporarily exempt from the 10% import tax, unless Trump decides to change the current 25% tax rate applied to these two countries. In addition, Trump also imposed a 25% tax on all cars manufactured outside the US, effective from April 4.

Trump asserted that this policy will protect domestic industry and bring more reasonable prices to American consumers. However, the market reaction shows great concern from investors.

Stocks and Cryptocurrencies Drop

Shortly after Trump's announcement, US financial markets plunged. Dow Jones futures lost more than 1,000 points, while the S&P 500 and Nasdaq also recorded significant declines.

The impact quickly spread to the cryptocurrency market. The cryptocurrency market capitalization fell 4% to $2.7 trillion. Bitcoin initially rose to $88,500 when Trump spoke but then plummeted to $83,073, down 2% in 24 hours. Ethereum fell 4% to $1,816, while Solana lost 5.2% of its value to $119.

Data from Coinglass shows that the sell-off resulted in $514 million in liquidations within 24 hours, with $290 million coming from long positions.

Market Forecast: What's Next?

Arthur Hayes, co-founder of BitMEX, told X that despite the negative market reaction, Bitcoin could still “get out of danger” if it holds above $76,500 until April 15, the US tax filing deadline. He warned investors not to get caught up in short-term volatility.

In a volatile market, investors need to closely monitor the next developments from both US economic policy and important technical indicators to make reasonable decisions.

-238x178.jpeg)

-238x178.png)