- JPMorgan Crypto Market Faces Downside Risks as Bitcoin and Ether Futures Demand Weakens

- FTX to Start Paying Creditors on May 30 After 27 Months in Bankruptcy

- MapScan – A Comprehensive Ecosystem Leading the Blockchain Era

- How MapNode Is Reshaping the Future of Digital Finance?

- Cryptocurrency Markets Plunge to Lowest Level Since November 2021 Following Bybit Hack and Memecoin Crash

- Ethereum Faces 95% Decline in Transaction Fee Revenue: Caused by Layer 2 Trends and NFT Decline

JPMorgan Crypto Market Faces Downside Risks as Bitcoin and Ether Futures Demand Weakens

The cryptocurrency market is facing a bearish risk as demand for bitcoin and ether futures on the CME is weakening, according to a report from JPMorgan. This reflects a decline in institutional investors' confidence in the two leading digital assets.

Warning Signs From the Market

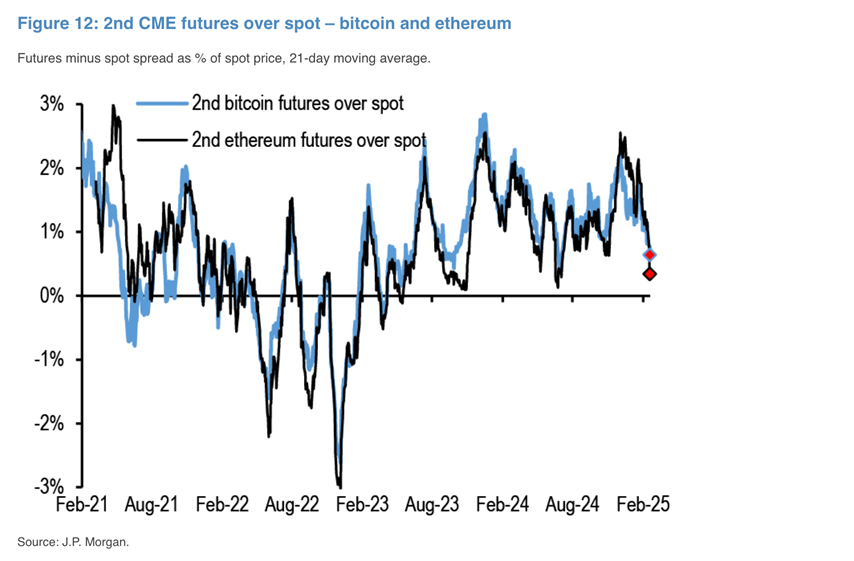

The total cryptocurrency market capitalization has fallen 15%, from a record high of $3.72 trillion on December 17 to around $3.17 trillion, marking a significant correction. The decline has pushed bitcoin and ether futures on the CME closer to a state of "backwardation"—when futures prices are lower than spot prices. According to JPMorgan analysts, this phenomenon occurred in June and July last year, indicating a negative signal for the market.

“This is a negative development and reflects weak demand from institutional investors who use CME futures to access the crypto market,” JPMorgan’s team, led by Nikolaos Panigirtzoglou, said in a recent report.

Declining Institutional Demand

When demand for bitcoin and ether futures is strong, their prices tend to be higher than spot prices, a condition known as “contango.” This price difference, which is typically over 10% per year, reflects the high risk-free interest rates in the crypto market, according to JPMorgan. USD loans in the crypto market typically yield between 5% and 10% per year.

However, when demand declines and price expectations weaken, futures can fall below spot prices. This phenomenon occurred in the middle of last year and is showing signs of returning, indicating a decline in confidence in the short-term growth potential of bitcoin and ether.

What is Pressuring the Market

JPMorgan analysts pointed to two main factors leading to the decline in demand for bitcoin and ether futures on CME:

Profit Taking Due to Lack of Positive Catalysts: Some institutional investors have started to take profits due to the lack of important catalysts in the short term. JPMorgan forecasts that major crypto-related initiatives from the new US administration are unlikely to happen before the second half of the year, causing investors to choose to stay on the sidelines and observe.

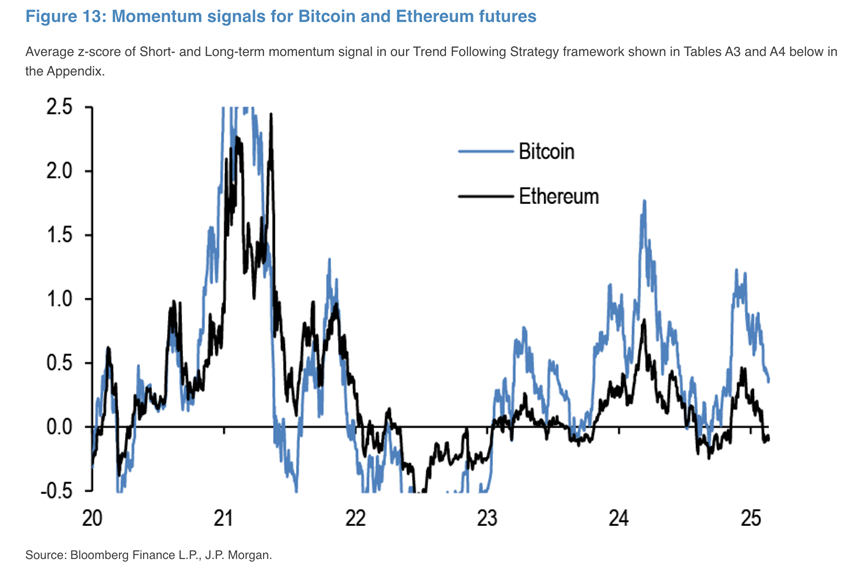

Momentum Funds Retreat: Momentum funds, such as commodity trading advisors (CTAs), have reduced their exposure to the crypto market. This continues to weigh on demand, especially as both bitcoin and ethereum momentum signals have declined in recent months. According to JPMorgan, ether’s momentum signal has even turned negative, suggesting that downside risks are still increasing.

Short-Term Forecast for Cryptocurrency Market

Given the above trends, JPMorgan warns that the cryptocurrency market may continue to be under pressure in the coming time. The lack of supporting factors and bullish momentum makes the short-term outlook for bitcoin and ether less optimistic. However, volatility remains an inherent feature of the cryptocurrency market, and recovery is still possible if macro factors and investor confidence improve.

In this context, investors need to closely monitor market developments and cryptocurrency-related policies from regulators, in order to have appropriate strategies to protect their portfolios from upcoming fluctuations.

-238x178.jpeg)

-238x178.jpeg)

-238x178.jpeg)